By

Economist Nouriel Roubini, nicknamed Dr. Doom for predicting the most recent global financial crisis, has crossed swords with cryptocurrency guru and Ethereum founder Vitalik Buterin. In the epic battle of words, both are right about some things, and neither is quite wrong. Theirs is a fundamental, and philosophical, conflict.

It started with Roubini’s testimony before the U.S. Senate’s Banking Committee on Wednesday (10/10/18). The New York University professor, who has long disparaged virtual currencies and the blockchain technology behind them, delivered a particularly stinging indictment of the industry.

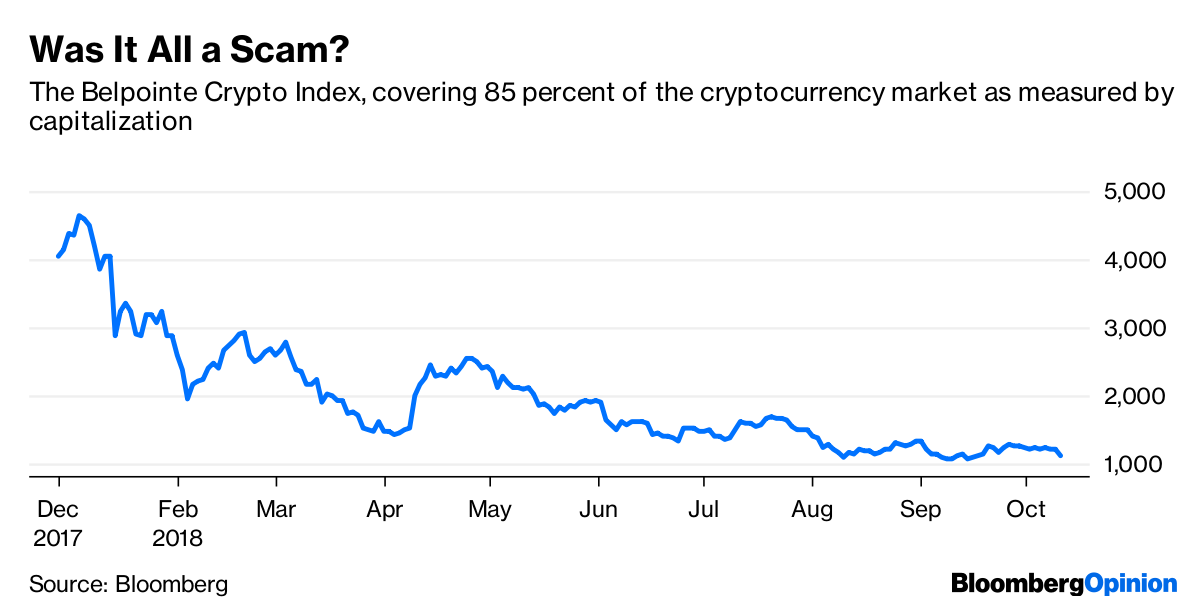

“Scammers, swindlers, criminals, charlatans, insider whales and carnival barkers (all conflicted insiders) tapped into clueless retail investors’ FOMO (“fear of missing out”), and took them for a ride selling them and dumping on them scammy, crappy assets at the peak that then went into a bust and crash — in a matter of months — like you have not seen in any history of financial bubbles,” said Roubini, about the crypto phenomenon of the past two years.

He made all the familiar arguments about cryptocurrencies: That they have no intrinsic value; that they impose transaction costs that are too high for small payments, making them useless as currencies; and that they use up too much energy to generate. He warned that Bitcoin, the most popular cryptocurrency, was deflationary in nature because of its finite supply (in a growing economy, that means prices denominated in Bitcoin cannot but fall) and that most of the other virtual currencies “have an arbitrary supply-generation mechanism that is worse than any fiat currency.”

Roubini pointed to research showing that almost four-fifths of all initial coin offerings have been outright scams. He argued that the crypto economy was concentrated in dodgy jurisdictions such as China and Russia, and that it created a wealth inequality “greater than that of Kim Jong-un land.”

As for the blockchain, it isn’t a revolutionary technology, the economist said, because the financial solutions based on it are not scalable, truly decentralized, or secure.

In short, Roubini’s testimony was a comprehensive, tersely argued takedown of crypto. But it was also full of personal attacks on Buterin for his failure to deliver a scalable system he’s promised since 2013, and even for the allegedly buggy code of his Ethereum platform.

Buterin was quick to counter with an attack on Roubini’s credentials. “I officially predict a financial crisis some time between now and 2021,” he tweeted. “Not because I have any special knowledge or even actually think that, but so that I can have a ~25% (or whatever) chance of later being publicly acclaimed as ‘a guru who predicted the last financial crisis’.”

This started off a debate between him and Roubini in several Twitter threads which can best be described as an economist’s conversation with a technologist; it’s not quite as bad talking over each other in two different languages, but it’s close. For example, Roubini attacked sharding — a technology meant to speed up transactions recorded on a blockchain — as “vaporware”; crypto enthusiasts quickly responded that Google used a version of it in cloud computing. On the other hand, Buterin had no clear answer to Roubini’s arguments concerning the immediate uselessness of crypto as a financial technology; all he could say, essentially, was that technological problems were in the process of being resolved.

The exchanges reflect a fundamental difference in worldview. The economist looks at the present state of affairs, and sees a familiar phenomenon: A hype-based bubble without workable fundamentals, and a highly imperfect technology that, at the moment, works worse than other solutions. (Roubini’s examples include fintech leaders such as PayPal and Alipay). The engineer sees a problem worth solving — in this case, removing a central approving and certifying authority from financial transactions, and all kinds of contracts — and works on solutions. For the economist, the current failure rate is important, and the sheer number of scams surrounding a particular technology triggers red alarms. For the engineer, the failures are merely inputs, and the scams are irrelevant.