Here is a very good (and topical) piece comparing Fiat currencies, Gold and Bitcoin. Store of value? Medium of exchange? Which is the true role of each and how do they compare over time, fully knowing that bitcoin is still a 'pup' in the financial world. This is an excellent insight from the CME Group's research and economic "smarties".

(Bill Taylor/CEO)

"An inherent tension exists between the two major purposes of money. Currencies that are perceived as great stores of value, such as gold and bitcoin, make for poor mediums of exchange. By contrast, currencies that are effective mediums of exchange, such as fiat currencies used the world over, can make for dubious stores of value. Where a currency falls on the store of value versus medium of exchange spectrum influences its usefulness as a unit of account and a standard of deferred payment.

Supply Scarcity and Stores of Value

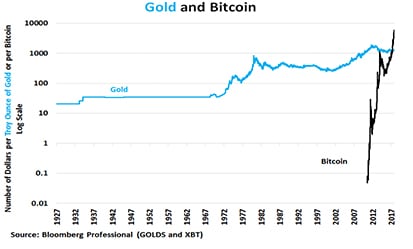

As stores of value, many investors perceive gold and, more recently, bitcoin as second to none. Since 1971, gold has appreciated from $35 per ounce to around $1,300 at the time of this writing, a gain of over 3,500%. Bitcoins have done even better. On July 19, 2010, a bitcoin was worth $0.08. At the time of this writing, it’s priced close to $5,300 per bitcoin, a gain of over 6,000,000% in seven years. Not bad!

Figure 1: Gold and Bitcoin Have Been Great Stores of Value.

Whether gold and bitcoin really are stores of value is not universally accepted. Viewed from a fiat currency perspective, such as that of the U.S. dollar, bitcoin and gold are, to say the least, not without risk. Over the past 12 months, the annualized standard deviation of gold has been 12%. Gold had a 70% drawdown between 1980 and 1998. Compared to bitcoin, the gold market looks sleepy. Bitcoin owners experienced a 60% annualized standard deviation over the past 12 months and in the past, it has achieved a mind boggling 175% annualized risk (Figure 2). Moreover, in its short life, it has already had drawdowns of 93% and 84% (Figure 3).

Drawdowns of such magnitude do sound crazy yet investors still allocate funds to other markets which have experienced large drawdowns. The U.S. equity market, which experienced an 89% drawdown between 1929 and 1933, from which it took until 1954 to recover. Since then, it has experienced a 47% drawdown in 1973-74, a 50% drawdown in 2000-2002 and a 60% drawdown from October 2007 to March 2009. Crude oil prices are currently 67% off their 2008 highs. The difference being, of course, that few investors would argue that stocks and crude oil are stores of value. Rather, investors perceive them as being risky investments..."

Full Story at

CMEGroup.com